Business finance from £3,000 to £500,000 in just 2 days! Here at Card Cutters, we take the hassle out of raising extra cash flow, with a fast and flexible business funding solution for UK businesses only.

Flexible funding on your terms

Unlike traditional bank loans, with our Merchant Cash Advance you can enjoy complete flexibility. There are no hidden fees or repayment deadlines. You only repay when you get paid.

Is a Merchant Cash Advance right for me?

Our Merchant Cash Advance is the perfect solution for businesses which experience seasonality or ebbs and flows in income.

How does it work?

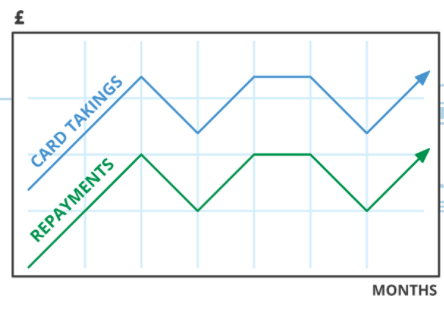

The amount you pay back is an affordable percentage of your daily card takings. A Merchant Cash Advance allows you to make repayments on your original advance amount through a low cost, fixed percentage of your credit card sales, which will be based on a number of sales from your customers.

With a Merchant Cash Advance if sales in the month following your advance are slow you will pay back less. If sales increase you will pay back the advance quicker but you will keep the same percentage of your sales ensuring your business has the cash flow to operate.

To qualify for a Merchant Cash Advance:

- You must take card payments.

- You have been trading for 6 months or more.

- Your monthly turnover is at least £6,000.

- Your monthly card sales are at least £3,000.

If your answer is yes to all of the above, you could receive funding from £3,000 to £500,000 in just a few days.

The application process is simple!

- Fill in our enquiry form.

- We will contact you to discuss your application further.

- If successful you could get an instant quote and approval within 24 hours.

- Get funded and access your money in just a few days.

- Repay the loan as and when you get paid.